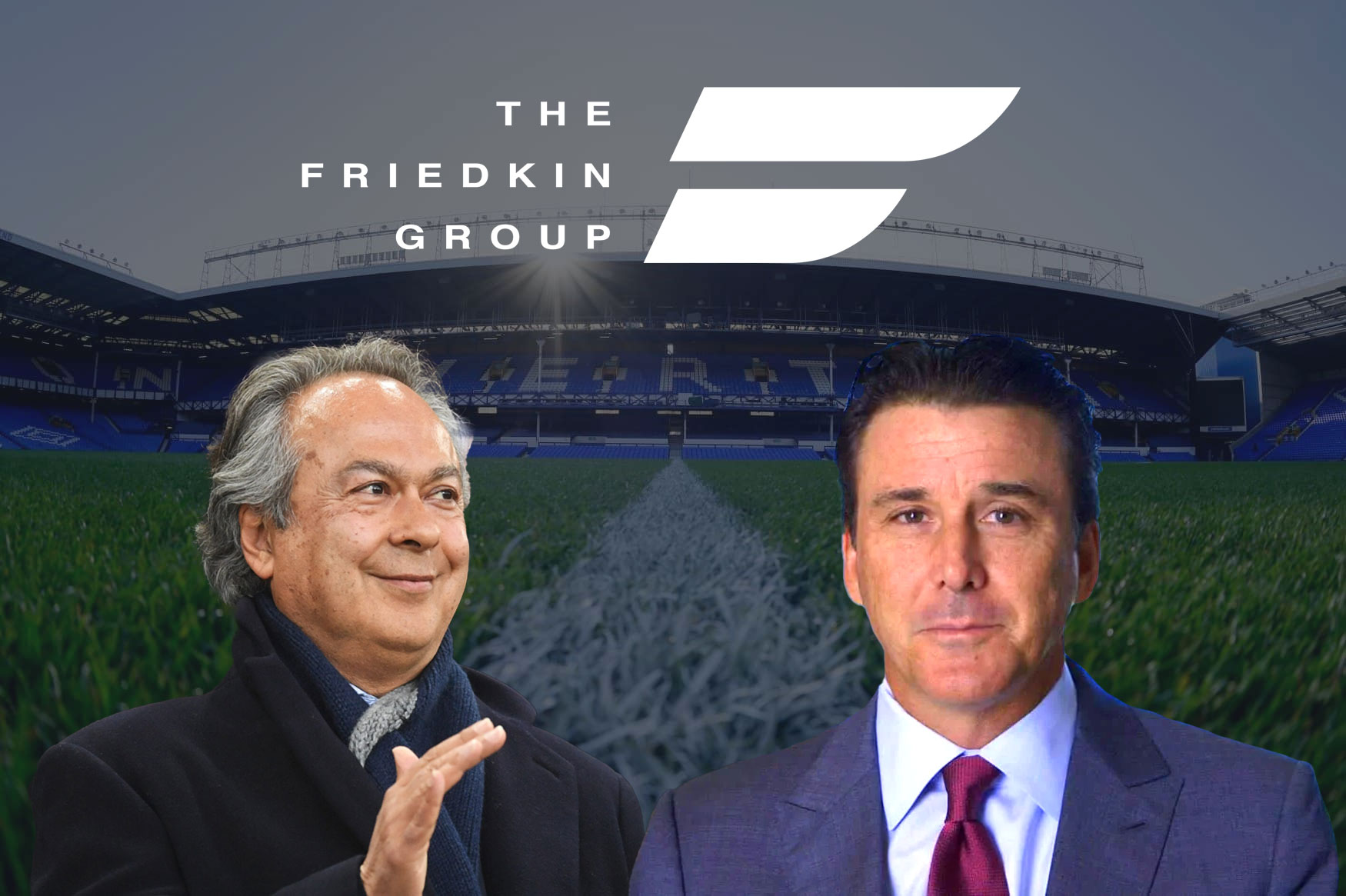

Takeover by The Friedkin Group ends the Moshiri years at Everton

The longest takeover saga in Premier League history finally came to an end today with the confirmation of The Friedkin Group’s purchase of Farhad Moshiri’s majority stake in Everton Football Club.

The agreement reached by the Anglo-Iranian and the Houston-based firm was approved by the Premier League, Women’s Professional Leagues Limited, the Football Association, and the Financial Conduct Authority and rubber-stamped by an independent oversight panel, paving the way for today’s announcement that brings to a close a two-year search by Moshiri for a buyer of his shares.

TFG’s takeover, reported to be in the region of £450m, was executed by a newly-formed entity called Roundhouse Capital Holdings Limited (Roundhouse) who replace Moshiri’s Blue Heaven Holdings as owners of the Club and are reported to have cleared a substantial amount of Everton’s estimated £660m debts.

A significant potion of that is said to involve paying off long-time creditor, Rights & Media Funding, and A-CAP, the American re-insurance outfit who have assumed the liabilities of 777 Partners after the would-be buyers of Everton were forced into administration earlier this year. Together, the two lenders were reputed to be owed more than £400m.

Additional debt, in the form of interest-free shareholder loans provided to the Club by Moshiri, was converted to equity via a new share issue prior to the conclusion of the deal and TFG’s buyout will include the issue of further shares that will eventually take their stake in Everton FC over 98%. The Toffees will augment the Friedkin’s motorcar, cinema, travel, sporting and entertainment portfolio that already includes AS Roma of Italy’s Serie.

Marc Watts, the President of The Friedkin Group and who also serves on Roma’s board, has been appointed Everton’s Executive Chairman while Ana Dunkel, The Friedkin Group’s Chief Financial Officer joins a board on which the Blues’ interim CEO, Colin Chong, will continue to serve. Neither Dan Friedkin, Chairman and Chief Executive of TFG, nor his son Ryan have taken roles at Everton at this time.

However, Dan, who has an estimated personal fortune of nearly £6.5m, penned a statement to his new Clubs supporters, introducing Watts and expressing his “immense pride in welcoming one of England’s most historic football clubs to our global family.

“Everton represents a proud legacy, and we are honoured to become custodians of this great institution,” he continued. The Friedkin Group … strive to deliver extraordinary experiences that ignite people’s passions. We are thrilled to bring this ethos to Everton and the Liverpool City Region.

“Whilst we are new to the Club, we fully understand the vital role Everton plays in local culture, history, and the lives of Evertonians here and around the world. We are deeply committed to honouring this legacy while contributing positively to the community, economy, and people of this remarkable city.”

Watts meanwhile, acknowledged the short-term challenges facing Everton after three years of austerity in the transfer market and as many fights against relegation, all while the playing squad has been stripped of its most saleable assets.

“Together, we will usher Everton into a new era, one that is marked by ambition and professionalism,” he wrote in a statement of his own. “As stewards of Everton, we look forward to showing our commitment to the club through actions, not words.

“Our long-term vision is to harness the passion of fans and great qualities of the Club to realise Everton’s full potential. Our goals are clear: Strengthening the men’s first-team squad through thoughtful and strategic investment. Cultivating home-grown superstars through Everton’s Academy. Fostering a distinct on-pitch and commercial strategy for the women’s team. Respecting the Club’s traditions and keeping Everton at the heart of the community. Maximising the potential of the new stadium through long-term commercial partnerships and events that benefit the city of Liverpool. Enhancing Everton’s reputation as a unique and historical name in world football.

“The road ahead of us is long and there will be further challenges to come, but we are committed to living by Everton’s motto: nil satis nisi optimum.”

Today’s news brings an end to the Moshiri era, which began with so much hope and promise when he first came on board as a major shareholder in 2016. Having explored potential deals with the Kaminski Group, MSP Sports Capital, 777 Partners and Crystal Palace shareholder John Textor, Moshiri’s deal with TFG allows him to extricate himself from what had become a hugely costly endeavour, one that came close to costing the Blues their place in the Premier League but will also leave them with a brand new, 52,888-seater stadium on the banks of the Mersey. He is expected to have recouped just a fraction of the estimated £850m he ploughed into Everton over eight years at the helm.

Though he spent hundreds of millions of pounds on player acquisitions and a succession of managerial hires, Everton’s fortunes plummeted on the pitch even while a thirty-year quest to resolve the issues posed by their ageing Goodison Park home was ended with the construction of the new ground at Bramley-Moore Dock. That arena will officially open its doors to professional football in August next year.

Reader Responses

Selected thoughts from readersEither no responses have been submitted so far to this article or previous submissions are being assessed for inclusion.

Add Your Thoughts

Only registered users of Evertonia can participate in discussions.

Or Join as Evertonia Member — it takes just a few minutes and will allow you to post your thoughts on artices across the site.